Here’s the uncomfortable truth nobody mentions aloud. Most startup stories sound like motivational Instagram posts today. You hear “disruption” and “innovation” repeated endlessly until meaning evaporates entirely. Yet, January 16, 2026 shifted something fundamental in India’s narrative. The numbers tell a staggering story: 200,000+ recognised startups, 21 lakh direct jobs created, India now ranks third globally in startup ecosystem strength. But here’s what kept me thinking: does scale without social purpose just accelerate failure faster? That’s precisely why National Startup Day in India matters differently this time around. The conversation changed from “how many startups?” to “what problems do they genuinely solve?”

I watched Piyush Goyal describe this decade-long journey with surprising candour. He noted that “young Indians today are more willing to take risks, move beyond fixed career paths and explore entrepreneurship without fear of failure.” That confidence shift matters more than any funding announcement ever could. Moreover, confidence without structural support simply channels desperation into dead-end ventures. The ecosystem has clearly strengthened, but accessibility remains unevenly distributed across India’s economic layers. This creates a pressing question: who truly benefits from this entrepreneurial explosion?

About 50% of startups now emerge from Tier-2 and Tier-3 cities, not metros. That statistic should feel revolutionary because entrepreneurship is finally decentralising. However, I’ve watched founders from smaller cities navigate poverty-level infrastructure with unequal mentorship access. So, when celebrating National Startup Day in India, remember that policy announcements travel faster than actual implementation networks ever could. The real revolution happens in garage workshops and college dorms, not in press conferences. This is where genuine purpose meets scalable ideas.

Understanding National Startup Day in India: Beyond the Rhetoric

What January 16th Actually Represents Today

National Startup Day in India marks Startup India’s official launch anniversary on January 16, 2016. Ten years later, it has evolved from a policy announcement into an institutional reality. The government consciously frames this day as celebrating entrepreneurial courage and innovation, reshaping national destiny. But language often masks uncomfortable truths beneath surface-level statistics and celebratory rhetoric. The real significance lies in culture transformation: risk-taking shifted from career suicide to career option overnight.

In 2016, India housed approximately 400-500 recognised startups scattered across metros. Today, 200,000+ ventures operate across all 625 districts, with more than half originating from Tier-2/Tier-3 cities. Prime Minister Modi stated on the occasion: “Startups are going to be the backbone of new India.” That’s not hyperbolic language; it’s strategic positioning. He emphasized three foundational pillars for continued growth. First, liberating entrepreneurship from governmental bureaucratic processes and rigid regulations. Second, creating institutional mechanisms specifically promoting innovation systematically, nationwide. Third, actively handholding young innovators through early vulnerable scaling phases.

The Acceleration Most People Miss Entirely

The decade-long journey transformed India’s startup landscape at unprecedented velocity. In 2016, recognised startups hovered below 1,000; today, 44,000 new startups gained recognition in 2025 alone. This represents the highest annual recognition rate since Startup India’s inception in 2016. Infosys co-founder Nandan Nilekari predicted boldly: “India will have 1 million startups by 2035.” His reasoning traced the “binary fission” effect where successful ventures spawn newer ventures endlessly. Each IPO exit creates wealth, mentorship capacity, and angel investment capital fueling successive waves.

Nilekani emphasised that “every successful startup creates hundreds more startups through reinvestment and mentorship.” This exponential multiplication operates like biological replication at systemic scale. He highlighted that digital public infrastructure built over a decade – UPI, Aadhaar, GST connectivity – created permissionless platforms enabling rapid experimentation. Artificial intelligence now acts as the next catalyst accelerating this multiplication cycle exponentially. Still, foundational infrastructure gaps remain visible when examining deeper geographical dispersal patterns carefully. The gap between metro-centric support systems and Tier-2 realities remain substantial.

Government Support Ecosystem: Schemes Powering Growth

| Scheme Name | Maximum Support | Key Benefit | Eligibility Criteria |

|---|---|---|---|

| Startup India Seed Fund Scheme (SISFS) | ₹50 lakh | Grants up to ₹20L for PoC; ₹50L for scale-up | DPIIT-recognised; Age <7 years |

| Income Tax Exemption (Section 80-IAC) | 100% relief (3 years) | Three consecutive years tax holiday | DPIIT-recognised; Turnover <₹100Cr |

| Angel Tax Exemption (Section 56) | Unlimited exemption | No tax on share premium | DPIIT-recognised; Funded by resident Indians |

| Fund of Funds for Startups (FFS) | ₹10,000 crore corpus | Capital access through registered AIFs | DPIIT-recognised; Investment stage |

| Credit Guarantee Scheme (CGSS) | Up to ₹2 crore | 80% credit guarantee on loans | DPIIT-recognised; Loans from banks/NBFCs |

| Patent Filing Support | 80% rebate | Fast-track examination included | DPIIT-recognised startups |

| PM Mudra Yojana (PMMY) | ₹10 lakh maximum | Collateral-free loans (3 categories) | Micro/small businesses; All sectors |

| Atal Innovation Mission (AIM) | Varies | Incubators, tinkering labs, mentorship | Students, entrepreneurs, institutions |

Source: Department for Promotion of Industry & Internal Trade (DPIIT), Startup India Official Portal, Government Schemes Compilation 2025-2026

Purpose-Driven Startups: Beyond Unicorn Vanity Metrics

Where Real Social Change Actually Happens Quietly

Unicorn valuations dominate media coverage because they attract eyeballs, capital, and prestige predictably. Interestingly, genuinely transformative startups often solve unglamorous problems: agricultural productivity, telemedicine access, microfinance, vocational education, environmental sustainability etc. These sectors create less dramatic news but more meaningful livelihoods. A farmer accessing real-time weather data through an agri-tech startup boosts crop yields and household income permanently. A village woman receiving specialist telemedicine consultation eliminates travel costs and time loss entirely. These are purpose-driven startups functioning as structural problem-solvers, not venture capital entertainment vehicles.

Piyush Goyal’s recent candid admission revealed policy-maker growth as well. Last April, he criticised deep tech startups openly, suggesting that founders focus elsewhere instead. Then he reconsidered after witnessing groundbreaking work in semiconductors, robotics, and advanced manufacturing. He acknowledged: “I would probably acknowledge that possibly at that point of time I was not as well informed.” This intellectual humility from government matters because policy shapes what gets funded systematically. He revealed that the government committed a second Rs 10,000 crore deep tech fund supporting next-generation entrepreneurs specifically. That pivot signals serious commitment toward high-impact, capital-intensive innovation domains.

The Tier-2/Tier-3 Revolution You’re Not Hearing Enough About

Approximately 50% of recognised startups now operate from cities beyond India’s traditional metros. That geographic distribution represents revolutionary democratisation of opportunities historically concentrated in Delhi, Mumbai and Bangalore. As a matter of fact, women comprise 45% of directors or partners across recognised startups, up significantly from earlier estimates. However, these founders navigate different challenges entirely: inconsistent internet connectivity, limited talent pools, less developed investor networks etc. Yet, they possess profound local knowledge, lower operational costs, and genuine community rootedness that traditional metros often lack entirely.

Tier-2 founders often build sustainable unit economics by necessity rather than virtue. Besides, they cannot afford burn-and-scale Silicon Valley playbooks because venture capital access remains limited deliberately. This constraint forces genuine product-market fit discovery before capital infusions cloud decision-making processes. Moreover, women-led startups specifically show three times faster growth from Tier-2/3 cities versus metro-based counterparts. This suggests that geographic diversity correlates with reduced network gatekeeping and increased meritocratic advancement. Consequentially, India’s entrepreneurial ceiling rises as opportunity distributes geographically and gender-wise equitably.

Employment Engine: Job Creation Across Sectors

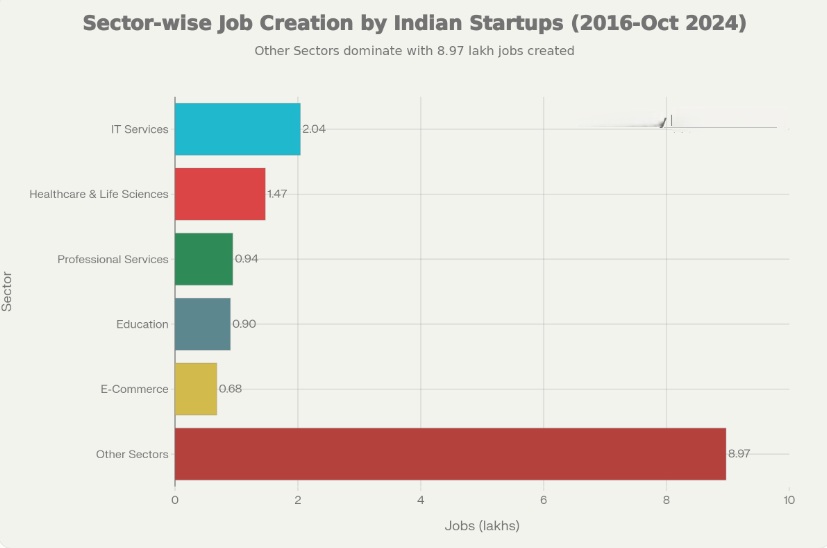

Source: Department for Promotion of Industry & Internal Trade (DPIIT), Startup India Data Portal, Jobs Created by Indian Startups Report 2016-October 2024

From 2016 to October 2024, Indian startups created 1.66 million direct jobs cumulatively. By end-2025, that figure reached 2.1 million with a continued acceleration trajectory. These aren’t speculative projections but verified recognitions from Department for Promotion of Industry and Internal Trade (DPIIT). Every single job represents real economic agency: a person earning income, building career trajectory, and contributing to household income. Due to this multiplier effect, research suggests 2-3 indirect jobs emerge supporting each startup role created. This means 21 lakh direct jobs quietly spawn 42-63 lakh indirect employment opportunities across supply chains.

The sectoral distribution reveals the strategic ecosystem diversity. IT services lead with 2.04 lakh jobs, followed by healthcare/life sciences (1.47 lakh), professional services (0.94 lakh), and education (0.90 lakh). Notably, “other sectors” comprising agri-tech, fintech, climate solutions, and ed-tech combined represent 8.97 lakh jobs. This suggests that emerging sectors increasingly compete with traditional IT service dominance. Quality matters beyond quantity: median startup salaries now exceed corporate entry-level positions in many verticals. However, skill mismatches persist, with 55% of startup hiring reporting capability gaps. Women occupy 18% of startup roles, up from 14% previously – there is progress definitely, but far from parity.

Government Procurement: The Multiplier Most Overlooked

The Government e-Marketplace (GeM) purchases approximately Rs 51,000+ crore from startups annually. This represents tangible, immediate revenue for verified vendors without traditional procurement delays strangling cash flow. In addition, GeM access democratises market entry for non-metro startups lacking relationships in traditional corporate procurement channels. Resultantly, one startup securing large government orders gains credibility, cash stability, and reference accounts simultaneously. This cascades into private sector confidence and follows-on with customer acquisition organically.

Simultaneously, the Startup India Seed Fund Scheme distributed Rs 585 crore approvals to 3,200 startup applications through incubators. Fund of Funds for Startups mechanism channeled Rs 25,320 crore capital through 1,350 startups via Alternative Investment Funds. Credit Guarantee Scheme for Startups disbursed Rs 775 crore across deserving ventures. These mechanisms collectively created capital conduits bypassing traditional banking gatekeeping. Banks remain hesitant toward startup lending because security requirements and collateral expectations diverge fundamentally from young venture needs.

Deep-Tech Ambitions: Manufacturing and Sovereignty

Where India’s Next Technological Leap Originates

Deep-tech startups now represent India’s explicit strategic ambition toward technological sovereignty. Mindgrove Technologies successfully taped out a 28-nanometre Secure-IoT chip indigenous design entirely. Agnikul Cosmos built India’s first domestically-designed rocket powered by singular 3D-printed engine. These achievements transcend commercial wins; they represent India transitioning from service provider toward technology originator. The government’s Design-Linked Incentive scheme directly funds semiconductor startups covering research and development. This deliberate backing signals deeptech development as strategic necessity, not optional luxury.

Deep-tech sectors attract disproportionate capital intensity but deliver multiplied national resilience ultimately. Quantum computing, artificial intelligence, advanced robotics, climate tech, aerospace all require patient capital and decade-scale development horizons. Venture capital typically demands 5-7 year exits; deep-tech timelines frequently extend 10-15 years minimum. This mismatch explains why government funding mechanisms, patient capital, and sovereign wealth interventions become structurally necessary. India’s Rs 1 lakh crore Research, Development & Innovation scheme explicitly backs AI, quantum, and semiconductor ecosystems.

Capital Flows: Funding Architecture Supporting Growth

Where Money Meets Ideas and Execution Risk

In 2024, India attracted $13.7 billion venture capital funding across 1,270 transactions, marking 45% year-on-year growth. Deal activity accelerated dramatically in 2025, reflecting institutional confidence returning post-funding winter consolidation period. Angel networks, VCs, and corporate venture arms increasingly partner rather than compete directly now. This collaborative model reduces founder navigation complexity navigating fragmented investor landscapes separately. Software, SaaS, and artificial intelligence verticals continue attracting majority capital allocation disproportionately.

However, capital access remains unequally distributed geographically and demographically. Women entrepreneurs in Tier-2/3 cities access external funding at merely 3% rates despite representing growing startup numbers. Founder networks, social capital, and relationship density still determine capital access more than idea quality often. Bootstrapped startups from non-metro regions frequently outperform venture-backed counterparts simply through necessity-driven discipline. This suggests that venture capital efficiency improves when capital distribution becomes more demographically and geographically democratic intentionally.

Women and Inclusion: Breaking Gatekeeping Structures Systematically

Beyond Tokenism: Real Governance and Capital Access Changes

Nearly 48% of recognised startups now include at least one-woman director or partner officially contributing to women’s empowerment. This represents substantial progress from earlier male-dominated startup culture memories. Yet, governance inclusion differs fundamentally from equitable capital access or opportunity distribution. Women-led startups secured only 11% of venture capital in 2024 despite comprising nearly 45% of founders. This capital gap directly constrains women founder scaling capacity relative to male counterparts receiving equal funding.

Interestingly, women entrepreneurs from Tier-2/Tier-3 cities show accelerated growth trajectories relative to metro counterparts. This suggests geographic diversity and gender diversity interact, reducing intersection gatekeeping complexity. Cultural factors play roles: smaller cities often demonstrate greater acceptance of women entrepreneurship relative to traditional family structures. Lower operational costs in Tier-2/3 regions mean limited capital constraints matter less proportionally. These dynamics suggest that true inclusion requires simultaneous geographic and gender equity initiatives implemented deliberately.

Challenges Remaining: Honest Conversations About Structural Gaps

Friction Points Preventing Maximum Ecosystem Potential Currently

Bureaucratic complexity continues strangling startup agility despite policy simplifications ostensibly implemented. Compliance procedures, GST calculations, labour regulations, environmental approvals remain burdensome for lean teams lacking specialist advisors. Founder workload often splits between building products and managing governmental relationships unproductively. Procurement timelines through GeM, though democratised, still consume startup cash reserves before payment receipt. Deep-tech ventures specifically report prototype-to-production scaling as brutally capital-intensive with limited intermediate funding.

Talent shortages plague manufacturing and deep-tech sectors disproportionately compared to software startups. India’s research and development spending remains at 0.64% of GDP – half of China’s 2.41% and one-fifth of the United States’ rates. This structural underinvestment starves foundational research necessary for breakthrough innovation domestically. Patent filing lags concerning numbers with artificial intelligence patent grant rates are particularly abysmal. Regional infrastructure disparities mean that Tier-2 founders still navigate internet inconsistency, logistics challenges, and talent recruitment obstacles systematically.

Eminent Voices: What Leadership Actually Says Today

Quotes That Reveal Strategic Thinking Beyond Press Releases

Prime Minister Modi framed the decade milestone with directness rarely seen in political rhetoric. “In just 10 years, the Startup India Mission has become a revolution. Today, India is the world’s third-largest startup ecosystem.” He continued purposefully: “The courage, confidence and innovation of startups is shaping India’s future.” This framing deliberately positions entrepreneurship as a civilisational contribution rather than corporate profit mechanism. He further stated: “Startup India is not just a scheme, it is a rainbow vision connecting diverse sectors with new opportunities.” That metaphor matters because rainbow symbolises inclusive possibilities rather than elite-only advancement.

Nandan Nilekani’s prediction carries weight because the Infosys co-founder credentials ground ambitious claims. “Every successful startup creates hundreds more through reinvestment and mentorship cycles in binary fission patterns.” This model explains how 150,000 current startups exponentially compound toward one million by 2035. He emphasised: “It’s a radical transformation, fuelled by a cycle of innovation, success, reinvestment and scale.” His nuance matters because he acknowledges that transformation requires foundational infrastructure, not merely entrepreneurial enthusiasm alone.

Piyush Goyal’s intellectual evolution demonstrated institutional capacity for learning and course correction gracefully. “I would probably acknowledge that possibly at that point of time, I was not as well informed about deep tech innovation.” This admission from the Commerce minister signals vulnerability and wisdom missing from typical political performance. He concluded: “The friction that followed ultimately catalysed significant financial backing from government decisively.” This reflects mature policymaking by allowing criticism to improve rather than defensively ignoring legitimate feedback channels.

Strategic Sectors Reshaping Rural India: Where Purpose Meets Scalability

Problem-Solving in Agriculture, Healthcare, Education Domains

Agri-tech startups now help farmers access real-time weather data, precision input recommendations, and direct market linkages digitally. These solutions eliminate costly middlemen systematically while improving crop productivity and household income directly. A farmer accessing market prices before harvest rather than post-harvest dictated prices represents democratised information and agency fundamentally. Telemedicine platforms bring specialist consultation to villages lacking doctors for basic diagnostics and treatment. This addresses geography-driven healthcare access failures where millions simply lack proximity to qualified practitioners.

Microfinance startups formalise credit access for informal workers excluded from traditional banking systems structurally. Vocational ed-tech platforms provide skills training reaching students unable to access traditional institutions geographically. Climate-tech ventures tackle renewable energy, waste management, and adaptation challenges affecting vulnerable populations disproportionately. These are purpose-driven startups addressing systemic problems quietly, without media fanfare, and creating profound multiplier effects. They exemplify why National Startup Day in India matters beyond unicorn valuations: foundational problem-solving carries greater national impact than disruptive consumer apps infinitely.

Trends Shaping 2026 and Beyond: What’s Next

Strategic Shifts Governing Capital Allocation and Policy

Artificial intelligence increasingly acts as a foundational technology enabling all sectors simultaneously now. Quantum computing research transitions from pure academic pursuit toward commercial applications that are explorable. Semiconductor manufacturing sovereignty becomes a geopolitical necessity beyond economic advantage calculations. Climate-tech and renewable energy infrastructure shift from niche to mainstream investment thesis. Space technology transitions from state monopoly toward competitive private sector participation gradually.

Policy indicators suggest deep-tech receives sustained governmental backing that is irreversible commitment-wise. Manufacturing-focused startups gain explicit support through production-linked incentives and capital provisioning. Geographic dispersal beyond metros receives intentional encouragement through ranked state startup policies systematically. Women founder support receives dedicated capital allocation and mentorship programming specifically. These trends collectively signal India’s ecosystem maturation toward long-term structural transformation beyond temporary policy enthusiasm cycles historically observed.

The Personal Dimension: Why This Matters for Your Life

How Individual Agency Compounds Into Systemic Change Ultimately

Ten years ago, I dismissed startup narratives as hype-driven adventures, disconnected from reality. Watching Tier-2 founders build genuine solutions for their communities, I reconsidered my opinions fundamentally. Entrepreneurship isn’t vanity; it’s active participation in nation-building through problem-solving. Every founder creating jobs enables household incomes; every investor funding purposes enables acceleration; every customer supporting Indian innovation strengthens ecosystem resilience.

This means three concrete personal actions matter immediately. First, if entrepreneurship attracts you, infrastructure now exists supporting experimentation affordably. Mentorship networks, seed funding, regulatory pathways all function at lower friction than previous decades. Second, if you work professionally, mentor one founder or join a startup advisory capacity deliberately. Your experience and networks compound their effectiveness exponentially through professional guidance. Third, consciously support Indian-built solutions even when international alternatives feel familiar. That purchasing decision strengthens ecosystem feedback loops and validates problem-solving focus repeatedly.

Holistic Vision: Growth That Includes Everyone Intentionally

Building Personal Habits While Contributing Socially Simultaneously

National Startup Day in India should inspire transformation beyond personal ambition toward collective capability building. Individually, adopt a “builder’s mindset” recognising problems as opportunities requiring iterative solutions. Learn continuously because ecosystems reward those staying current with technology and market shifts. Build networks intentionally with diverse perspectives, sectors, geographies, ensuring that groupthink doesn’t calcify thinking. Practice intellectual humility like Piyush Goyal demonstrated, revising positions when evidence contradicts assumptions publicly.

Collectively, we must support policy evolution removing structural inequalities systematically. Affordable high-speed internet reaching villages remains an essential infrastructure gap. Land access for startups, regulatory streamlining, and capital flowing towards neglected regions requires a deliberate push. Celebrate founders solving hard problems slowly over those chasing valuation vapour quickly. Measure success through genuine impact, sustainability, and opportunity distribution rather than mere scale metrics alone.

Personal growth cannot justify social cost concentration within privileged groups. Ask yourself: whose livelihoods improve through my work? What environmental impact do my decisions create? Does this distribute opportunity or concentrate privilege further? These questions feel secondary in competitive environments, but they’re foundational for India’s long-term stability and prosperity ultimately.

Three Concrete Steps To Take

Making National Startup Day Personal and Actionable

Action One: Follow one purpose-driven startup solving real problems in education, healthcare, agriculture, or climate sectors directly. Use their product or service intentionally, providing market feedback through actual engagement. Share your honest experience publicly, amplifying awareness within your networks substantially.

Action Two: If you work professionally, propose partnership pathways between your organisation and startups deliberately. Create purchase orders, co-innovation engagements, or pilot customer relationships funding early-stage ventures. Corporate engagement remains the most underutilised multiplier accelerating startup scaling beyond pure venture capital dynamics.

Action Three: Share one founder’s story – whether a friend, a published case study, or a local innovator – within your networks openly. Visibility breeds opportunity silently; most breakthrough scaling happens via word-of-mouth far exceeding media coverage impact. Your recommendation holds credibility that media articles never could in trusted social circles.

National Startup Day in India celebrates courage, but real revolution happens through ordinary Indians deciding to build extraordinary solutions. The real transformation occurs in garage workshops, college dorms, and small-town offices where risk-takers innovate and execute ideas that meet purpose.

#StartupIndia #NationalStartupDay #PurposeDrivenStartups #IndianEntrepreneurship #Tier2Startups