The Numbers That Whisper Uncomfortable Truths

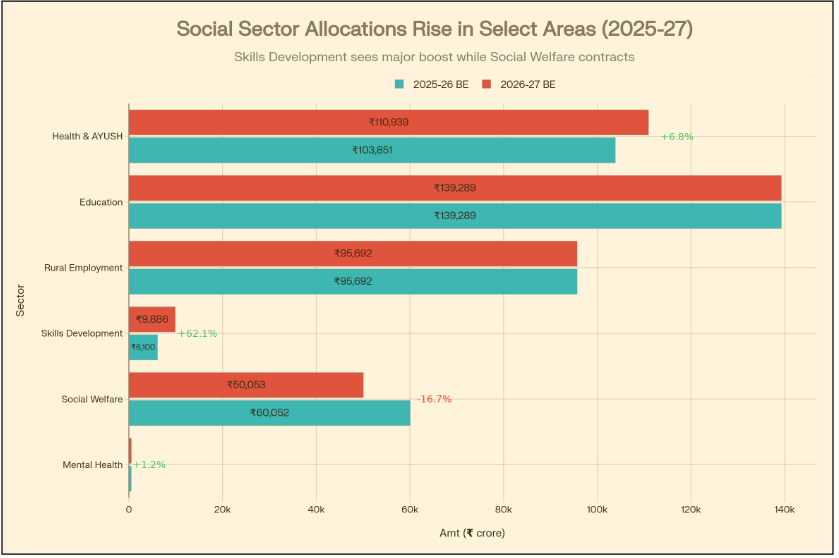

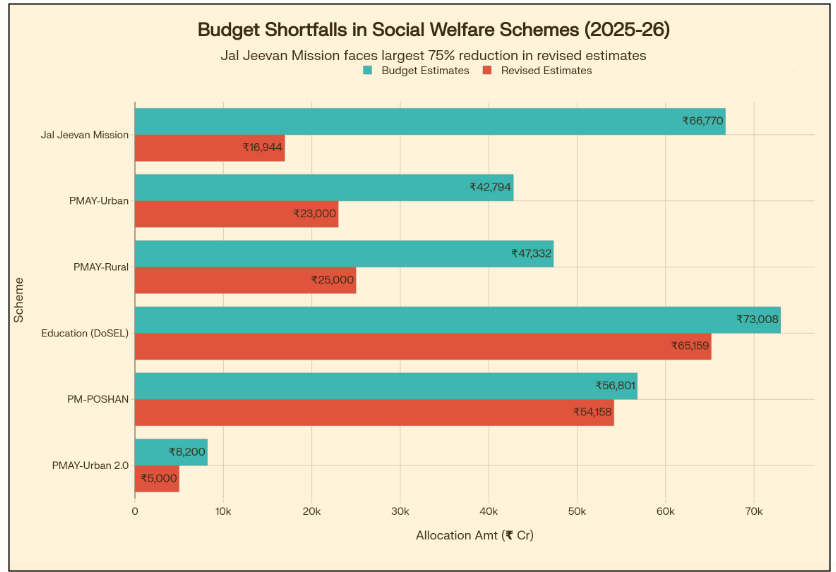

February 1st, 2026: The Union Budget 2026-27 is presented and the Finance Minister, Nirmala Sitharaman announces ₹1.06 lakh crore for health, ₹9,886 crore for skilling, ₹95,692 crore for rural employment. The headlines scream “historic investments.” However, buried in the fine print is a confession that never makes it to prime-time news: of the ₹67,000 crore promised for water in 2025-26, only ₹17,000 crore actually reached villages. Of ₹42,794 crore pledged for rural housing, merely ₹23,000 crore materialized.

This is not a case about heartless bureaucrats or fiscal incompetence. This is about structural contradiction at the heart of India’s social contract – the chasm between what governments announce from Parliament steps and what actually transforms lived experience in villages, towns, and urban slums across the nation.

This blog isn’t your standard budget analysis. I’m going beyond headlines to examine who actually benefits from the Union Budget 2026-27, who gets left behind despite all the fine words, and why the most eloquent budget speech cannot hide a fundamental truth: India’s social sector is starving while infrastructure gets gorged.

The Skilling Mirage – ₹9,886 Crore of Breathtaking Ambition

The Gain That Makes Headlines Sing

Let me be candid about one thing: the Union Budget 2026-27 genuinely surprised me on skilling.

The Ministry of Skill Development and Entrepreneurship received ₹9,886 crore in 2026-27 – a staggering 62% jump from ₹6,100 crore in 2025-26. This is the largest allocation in the ministry’s history. The government isn’t just talking about skilling; it’s betting on it as the primary engine for employment transformation. Content Creator Labs will mushroom across 15,000 secondary schools and 500 colleges. Five University Townships will emerge in industrial corridors, marrying education to factory floors. The AVGC (Animation, Visual Effects, Gaming, Comics) sector commonly called the Orange Economy– projected to need 2 million professionals by 2030 – gets formal infrastructure. Allied Health Professionals will expand by 100,000 across 10 disciplines over five years.

For a young person from rural Vidarbha or tribal Chhattisgarh, this matters. You no longer need to migrate to Bangalore to train in visual effects or game design. Your school might offer it. A girl from Gujarat can now access STEM hostels and engineering apprenticeships without leaving her district. This matters in ways that are difficult to overstate when your family has limited resources. Nipun Sharma, CEO of TeamLease Degree Apprenticeship, captured something essential: “By solving the housing crisis for female learners through the ₹10,000 crore District Hostel scheme, we can now mobilize the 42% of undergraduate women who currently drop out of the workforce pipeline.” As a result, structural barriers to women’s participation might finally get addressed through infrastructure, not just exhortation.

The Union Budget 2026-27 pivots away from the tired obsession with “job creation numbers” toward a harder question: are we building genuine employability? The newly proposed Education-to-Employment Standing Committee will map skill gaps in real-time, identifying high-employment sub-sectors and assessing AI’s labour-market impact. This is evidence-based policymaking attempting to replace the usual wishful thinking.

Where Reality Meets Aspiration: The Implementation Crisis

But here’s the pause that every thinking person should take.

Economist Venkatesh Atreya, analyzing the Union Budget 2026-27, offered a withering observation: “Skilling programmes are not an answer to unemployment. Skilling has been talked about repeatedly over the last few budgets, but skilling is not a substitute for employment. Unemployment in India is structural and widespread, particularly in rural areas.” Let that settle in.

India’s skill training apparatus is notoriously leaky. According to government data cited in Bloomberg’s analysis, less than 0.1% of hundreds of thousands trained in Industrial Training Institutes (ITIs) were recorded as being placed in companies. The vast majority either can’t find jobs aligned with their training or get placed in informal, precarious roles paying poverty wages. Parents mortgage land to send children to vocational schools; these children return after training to discover there are no jobs offering what they learned.

The actual problem isn’t lack of skilling allocations. The problem is the economy isn’t creating enough formal jobs. Manufacturing hasn’t accelerated since 2018. Services growth is real but concentrated in metros and Tier I cities. Rural areas continue shedding agricultural jobs without absorbing workers into non-farm employment. Youth unemployment, even among the educated, hovers at 9-10% in metros and far worse in smaller towns.

Moreover, institutional memory warns us: large budget allocations for skilling have a terrible track record of underspend. The 2025-26 allocations for education schemes (₹73,008 crore) resulted in actual spending of only ₹65,159 crore – a ₹7,849 crore shortfall. Will the new ₹9,886 crore meet the same fate? History suggests we should be skeptical until we see revised estimates at mid-year.

The uncomfortable truth: Skilling is being positioned as a substitute for the harder work of generating aggregate demand, reviving manufacturing, reforming labor regulations, and strengthening rural non-farm employment. It’s intellectually easier and cheaper to announce training programs than to fundamentally restructure how the economy creates jobs.

The Skilling Promise vs. The Employability Reality

Health Expansion – ₹1.06 Lakh Crore That Masks Deeper Starvation

The Headline That Looked Promising Until You Read Further

The Union Budget 2026-27 allocated ₹1,10,939 crore to Health and AYUSH – a 10% nominal increase from ₹1,03,851 crore in 2025-26. This is the largest-ever health budget. Five billion people worldwide watched India’s health spending announcement.

The reforms buried within are genuinely progressive. 1.5 lakh caregivers will be trained in geriatric and allied care – finally recognizing care work as formal employment. NIMHANS-2 and upgraded Regional Mental Health Institutes in Ranchi and Tezpur address the unconscionable gap: there are no national mental health institutes in north India despite the region being home to 600+ million people. Regional Medical Hubs will combine treatment, education, and research in public-private collaboration. AB PM-JAY (Ayushman Bharat) allocations increased, suggesting commitment to the poorest households’ catastrophic health expenses.

For me personally, as someone who’s tracked India’s health crises for years, this acknowledgment of care work is revolutionary. It legitimizes what has been invisible labour: elderly care, childcare, wellness support. A woman in Rajasthan can now train in geriatric care, earn ₹8,000-12,000 monthly, and contribute to formal GDP rather than remain an unpaid family caregiver. This reshapes how we value work and who we recognize as economic contributors.

The Real Numbers, Adjusted for Reality

This deserves careful attention – the increase is 3.5% in real terms (inflation-adjusted), not the headline 10%. When you account for price inflation, the actual buying power increase is thin.

More critically, health spending as a percentage of GDP has actually declined from 0.37% (2020-21) to 0.28% (2026-27). Let that sink. As India’s economy grows and government revenues expand, the share devoted to health shrinks. The WHO recommends 5-6% of government budgets for health; India allocates 3%.

The National Health Mission – backbone of public healthcare reaching 900+ million people – shows real-term declines of 8% since 2021-22 when adjusted for inflation and population growth. Public health workers (ASHAs, ANMs, nurses, MPWs) who risked their lives during COVID haven’t received significant wage enhancements or hiring expansion. District hospitals lack diagnostic equipment. Primary health centers in rural areas often exist as buildings without functioning staff.

Meanwhile, the Union Budget 2026-27 promotes “Medical Value Tourism hubs“ and “AYUSH institutions“ signaling a pivot toward private-market driven healthcare over public-sector strengthening. This is a fundamental choice: build better government hospitals serving the poor, or build premium tourism hospitals serving the rich?

Union Budget 2026-27: Social Sector Allocations

Source: Union Budget 2026–27 Speech PDF (MoF, indiabudget.gov.in)

Consider the metrics: India’s Maternal Mortality Ratio (MMR) is 97 per 100,000 live births – higher than many low-income countries. Infant mortality remains at 28 per 1,000 live births. Over 40% of children under 5 experience malnutrition. These aren’t problems that evaporate with nominal allocation increases. They require sustained, real-term investment in basic public health systems.

The Care Economy Paradox

Here’s where it gets complicated. The emphasis on caregiving is genuinely positive – it’s recognizing an essential sector and creating dignified employment. Simultaneously, without simultaneous public health strengthening, what emerges is a “care economy” that absorbs low-wage female workers into individualized, privatized care (elderly care, childcare) while systematically defunding the collective public health systems that prevent disease in the first place. It’s like cleaning your house one room at a time while ignoring the structural rot in the foundation.

The Implementation Trap – Why ₹67,000 Crore Becomes ₹17,000 Crore

The Pattern That Nobody Talks About Candidly

I want to walk you through something that keeps policy experts awake at night: the systematic chasm between Budget Estimates (BE) and Revised Estimates (RE).

Here’s the data that should alarm you:

Jal Jeevan Mission (Water Infrastructure)

- Budget Estimate 2025-26: ₹66,770 crore

- Revised Estimate 2025-26: ₹16,944 crore

- Shortfall: ₹49,826 crore (75% underspent)

The mission promised tap water to 19.23 crore rural households. As of today, only 55% have functional connections despite five years of implementation. 150+ million rural Indians depend on manual water collection, open wells, or contaminated groundwater. Women spend 8-10 hours weekly fetching water—time diverted from education, employment, or rest.

Pradhan Mantri Awas Yojana (Rural Housing)

- Budget Estimate 2025-26: ₹47,332 crore

- Revised Estimate 2025-26: ₹25,000 crore

- Shortfall: ₹22,332 crore (47% underspent)

PMAY-Urban (Urban Housing)

- Budget Estimate 2025-26: ₹42,794 crore

- Revised Estimate 2025-26: ₹23,000 crore

- Shortfall: ₹19,794 crore (46% underspent)

Combined housing shortfall: ₹42,126 crore. Meanwhile, 10+ million urban poor live in slums; 100+ million rural households inhabit inadequate housing (thatched roofs, mud walls, no sanitation). Without secure shelter, every other social program faces structural constraints.

Education (Samagra Shiksha)

- Budget Estimate 2025-26: ₹41,250 crore

- Revised Estimate 2025-26: ₹38,000 crore

- Shortfall: ₹3,250 crore (7.9% underspent)

PM-POSHAN (School Meals)

- Budget Estimate 2024-25: ₹56,801 crore

- Revised Estimate 2024-25: ₹54,158 crore

- Shortfall: ₹2,643 crore (4.7% underspent)

Critical Implementation Gaps: Budget Estimates vs Actual Spending

Source: Expenditure Union Budget 2026–27 (MoF, indiabudget.gov.in)

Why Does This Happen? (And Why Should You Care?)

The explanations vary: weak state capacity, bureaucratic delays, corruption at district/block levels, inadequate staffing, insufficient community demand (poor households lacking documents, information, or trust in schemes), supply-side constraints (lack of materials, skilled workers). But the pattern repeats year after year after year.

Interestingly, it’s not random incompetence. It is systematic underspend driven by fiscal constraints competing with interest payments. Interest payments alone have ballooned from ₹11.37 lakh crore in FY 2025 to ₹12.76 lakh crore in FY 2026 – consuming an ever-larger share of revenue expenditure and squeezing discretionary welfare spending.

The government can’t expand welfare spending sufficiently without widening fiscal deficits beyond acceptable thresholds. So it announces large allocations (creating a positive optics narrative) then revises them downward mid-year (fiscal discipline). The gap between promise and delivery becomes a feature, not a bug, of budget strategy. This is the deepest structural problem: not what’s allocated, but the systemic inability to execute and the fiscal constraints preventing meaningful expansion.

The Sectors That Disappeared From the Union Budget 2026-27 Entirely

Agriculture: The Invisible ₹600-Million-Person Elephant

Here’s what genuinely unsettled me while researching this budget: agriculture barely registers.

Despite 600+ million Indians depending directly on farming, the sector receives roughly 2-3% of total government spending – a proportion that hasn’t meaningfully shifted in a decade. New schemes are announced (AI advisory, drone subsidies, high-value crops) but they’re peripheral to the core crisis: farmer debt at ₹20+ lakh crore (historically highest), 12,000+ debt-driven suicides annually, crop insurance claim rejection rates exceeding 50% in many states, post-harvest losses of 30%+ due to storage/processing deficits.

The budget’s agricultural allocations show a structural gap of ₹53,000 crore between BE and RE in 2025-26 – from ₹1.59 lakh crore (BE) to ₹1.51 lakh crore (RE). This isn’t accounting for inflation. In real terms, agricultural support purchasing power has contracted significantly.

Small and marginal farmers – 80% of India’s farm population – can’t access formal credit at reasonable rates. Drones and precision farming are wonderful for commercial farmers with capital and technical literacy. For someone cultivating 0.5 hectares in drought-prone Maharashtra using traditional methods, AI advisory means nothing if:

- Crop insurance doesn’t pay when disaster strikes

- MSP doesn’t cover production costs

- Credit remains inaccessible

- Debt traps force asset sales

The budget’s silence on structural agricultural reform is its loudest confession: India lacks the political appetite to reform the agricultural sector despite recognizing it’s a poverty trap. This manifests in rural migration. 50+ million rural poor migrate to cities annually chasing non-farm employment. Villages empty of youth. The countryside depopulates. This isn’t development; it’s managed decline.

Mental Health: ₹51 Crore for 1.4 Billion People

Do the math: ₹0.036 per capita annually for mental health. For comparison, a cup of coffee costs ₹50.

India faces a mental health catastrophe: 150+ million people with depression, anxiety, or other psychiatric disorders. Suicide deaths exceed 350,000 annually – among the world’s highest. In spite of this, the National Tele Mental Health Programme received ₹51 crore (up from ₹45 crore – marginal).

Most states have one psychiatrist per 2-5 million people (vs. recommended 1 per 100,000). Rural areas have virtually none. No crisis hotlines in villages. Zero dedicated funding for community counseling, school mental health programs, workplace support, or anti-stigma campaigns.

The Union Budget 2026-27 proposes NIMHANS-2 and upgraded institutes for which infrastructure is needed. But operational funding for immediate mental health response is essentially absent. No allocation for substance abuse treatment networks, grief counseling for disaster survivors, PTSD support for accident victims, or specialized services for marginalized communities (Dalit women, tribal populations, LGBTQ+ individuals facing compound vulnerabilities).

What gets lost in this gap? Lives. Farmers facing debt spiral into suicidal ideation. Women experiencing domestic violence develop untreated depression. Youth facing employment failure lose hope. The elderly experience profound isolation in multi-nuclear families.

This isn’t a budget oversight. It’s a societal confession: we’ve decided mental health isn’t worth funding.

Women’s Structural Disadvantage: The Employment Guarantee Paradox

The Union Budget 2026-27 increased rural employment guarantee from 100 to 125 days under the new Viksit Bharat Gram Rozgar Mission (G-RAM-G) with ₹95,692 crore allocation. Additionally, SHE-Marts will enable 1.5 crore women entrepreneurs beyond credit access.

This sounds empowering. But there’s a structural trap.

The restructuring from demand-driven (MGNREGA) to allocation-driven (G-RAM-G) means states get fixed “normative allocations.” If rural demand exceeds allocations – due to drought, flood, or economic collapse – there’s no guarantee of additional employment. Fiscally weak states must co-finance at 60:40 ratios, which they can’t afford during crises.

Women comprise 58% of MGNREGA workers. This restructuring removes employment certainty – precisely the safety net that protects women when they have no other fallback. Without guaranteed employment, women get forced to accept lower agricultural wages rather than accessing guaranteed work. Economic bargaining power collapses.

The SHE-Marts are positive, but without employment guarantee, the poorest women lose structural protection.

The Disability Crisis – ₹300 Crore for 120 Million Needs

The Gain That Feels Like Tokenism

The Union Budget 2026-27 introduces two disability schemes: Divyangjan Kaushal Yojana (₹200 crore) and Divyang Sahara Yojana (₹100 crore). Over five years, 20,000 Persons with Disabilities will be trained in IT, AVGC, hospitality, food services. Assistive device production scales; PM Divyasha Kendras modernize into “Assistive Technology Marts.”

For 120+ million Divyangjan, this allocation represents ₹25 per person annually. The aid and appliances scheme saw only marginal increase: ₹330 crore to ₹375 crore. Meanwhile, 40% of Divyangjan cannot work due to spinal injuries, intellectual disabilities, severe sensory impairments, or multi-disabilities requiring intensive support.

The budget’s disability approach is employment-centric, reflecting a fundamental misunderstanding: Divyangjan faces barriers beyond training – stigma, accessibility, family obligations, discrimination, and care needs. You can’t task-orient your way into solving those through AVGC training alone.

What’s missing? Accessibility infrastructure. No funds for accessible public transport, government buildings, or digital platforms. Moreover, there is no money for community-based rehabilitation, vocational guidance, caregiver support. In addition, there is no addressing the fact that most public health facilities lack accessible toilets and ramps. The Union Budget 2026-27 doesn’t even acknowledge that accessibility is foundational – that without it, employment training becomes a beautiful theory meeting brutal practice.

Social Welfare Collapse – From ₹60,052 to ₹50,053 Crore

The cut that hurts quietly

Social welfare rarely trends on social media because it lacks glamour. However, it quietly keeps millions from falling through the floor. In Union Budget 2026–27, social welfare allocations dropped from ₹60,052 crore to ₹50,053 crore, a cut of roughly ₹9,999 crore (about 16.6%). This encompasses pensioner schemes, widow support, elderly care, and poverty alleviation programs. On paper, that can look like “just a line item adjustment.” On the ground, it often shows up as delayed pensions, thinner outreach, and tighter eligibility filters that the poorest struggle to navigate. If you’re wondering why this feels like a big deal: social welfare works like shock absorbers – when you remove them, every bump hits harder.

Who feels it first (and why it matters socially)

This cut hits people without buffers: older adults on small pensions, widows, people with chronic illness, and families living close to the edge. In a high-volatility economy, welfare isn’t a “freebie”; it’s risk insurance against hunger, debt spirals, and distress migration. The ripple then travels outward – reduced welfare often weakens local demand for essentials, which affects small shops and informal workers too. The dark satire is that we call it “fiscal prudence,” while households experience it as “private austerity,” unpaid care burdens included. If fiscal discipline is the goal, smarter design usually beats blunt cuts – inflation-indexed benefits, simpler access, and predictable on-time delivery protects dignity while reducing waste.

The Conversation We’re Not Having – Inequality Architecture

Why distribution beats announcements

Big allocations can still deliver small change, because distribution decides who benefits. Education may rise nominally, yet it still sits at about 2.6% of total expenditure in 2026–27. Incidentally, this signals a limited fiscal priority for the service that most determines social mobility. Meanwhile, health priority has weakened over time: analyses of Union Budget 2026-27 trends show health spending as a share of GDP falling from 0.37% (2020–21 actuals) to about 0.28% (2026–27 BE); so “more money” can still mean “less emphasis.” At the same time, capital expenditure is budgeted at ₹12.21 lakh crore in 2026–27, with PRS India noting an 11.5% increase over 2025–26 RE – useful for growth but not automatically equalising. Consequently, households with means increasingly buy private schools, private coaching, and private healthcare, while others remain tied to public systems that feel permanently “just short.”

The feedback loop that locks inequality

Here’s the loop: weaker public education and health reduce skills and productivity. As a result, job quality drops, and households lean harder on debt and informal work. That fragility multiplies when basics fail – because if a family can’t rely on schools and clinics, it starts rationing nutrition, learning, and preventive care for the next generation. Capex can help, but if human development spending doesn’t keep pace, growth distributes upward while risk distributes downward. In reality, capex expansion fails to create jobs, unemployment persists, and poverty doesn’t decline despite growth.

This is the deepest inequality architecture: the budget, through allocation choices, perpetuates and amplifies existing inequality structures. Those with money can buy private education and healthcare; the poor depend on public systems starved of resources. As public systems deteriorate, inequality widens.

Implementation as the Real Crisis

BE vs RE: the “promise–delivery” gap in numbers

Budget Estimates (BE) sound definitive on Budget Day, but Revised Estimates (RE) reveal what actually happened mid-year. The most striking example is Jal Jeevan Mission (JJM): ₹66,770 crore (BE 2025–26) fell to ₹16,944 crore (RE) – a drop of nearly 75%. Housing shows a similar pattern: PMAY-Rural moved from ₹47,332 crore (BE) to ₹25,000 crore (RE) and PMAY-Urban from ₹42,794 crore (BE) to ₹23,000 crore (RE) – roughly 46–47% underspend in both. Put together, these gaps don’t just “delay projects”; they delay tap water, roofs, sanitation, and basic dignity – then they quietly push households back toward informal coping (debt, migration, unpaid care).

Why execution fails: capacity limits and fiscal squeeze

Implementation gaps aren’t only about “leakage”; they often reflect administrative capacity, conditionalities, and fiscal constraints that choke delivery. In Parliament, the Jal Shakti minister explicitly linked the lower JJM RE to states needing to fulfil conditions and address complaints before funds flowed – an administrative gate that can slow spending even when needs remain urgent. At the macro level, interest payments compress the room for welfare: PRS India notes that in FY 2025–26, interest payments were about 25% of total expenditure and 37% of revenue receipts, which crowds out discretionary social spending and encourages mid-year “pruning” through RE. Hence, the real crisis is not that India lacks schemes; it’s that schemes routinely collide with capacity and cash-flow constraints. Due to this, the budget’s social impact lives or dies in implementation, not announcements.

Davos + India–EU FTA – Global Deals, Domestic Delivery

The Davos narrative meets Budget plumbing

Davos works like a global audition, and India usually sells scale plus stability. The Union Budget 2026-27 backs that pitch with capex at ₹12.2 trillion and heavy emphasis on logistics, corridors, waterways, and coastal shipping – because investors love one thing more than optimism: predictable movement of goods.

When the Budget talks about trust-based, technology-driven customs and clearance – Authorized Economic Operator (AEO) duty deferral, longer advance ruling validity, and automated processes – it quietly converts “India is open for business” into “India can clear your cargo faster.”

I read this as a social story too: better logistics can mean more factory and services jobs, especially beyond metros, if MSMEs and smaller exporters can actually plug into the system. Satirically, Davos can’t fix potholes, but this Budget tries to – at scale.

India–EU FTA – Why Budget trade moves matter socially

The India–EU FTA is positioned as a major liberalisation step, with the EU describing tariff reduction/elimination across most goods exports as a core feature. That kind of trade opening only becomes socially meaningful when small producers can export; not just large corporates. The Union Budget 2026-27‘s move to remove the ₹10 lakh cap on courier exports is a quietly powerful MSME lever for e-commerce exporters, artisans, and start-ups.

Likewise, sector-specific export facilitation – like tweaks for marine processing inputs, leather/footwear inputs, and longer export periods signals an attempt to protect labour-intensive jobs where livelihoods depend on steady demand. Special Economic Zone (SEZ) rule changes and concessional Domestic Tariff Area (DTA) sales proposals aim to keep export ecosystems competitive while lowering friction, which can translate into more stable employment chains from shopfloor to shipping.

Still, I’d flag one social caveat: trade-led growth will widen inequality if skilling, compliance support, and access to finance don’t reach smaller firms fast – so the Budget’s MSME support (including the SME Growth Fund) becomes the make-or-break bridge between “FTA opportunity” and “people-level gains”.

Global Context – How India Compares

The BRICS Comparison That Matters

India’s health, education, and welfare spending lags peer nations significantly:

Health Spending (% of GDP):

- India: 0.28-0.37%

- Brazil: 3.7%

- South Africa: 4.5%

- China: 5.1%

- Russia: 5.3%

Education Spending (% of GDP):

- India: 0.36% (government) + 0.5% (private) = 0.86% total

- Brazil: 6.7%

- South Africa: 6.0%

- Russia: 5.3%

Per Capita Health Spending (US$):

- India: $37

- Brazil: $1,050

- South Africa: $720

- China: $875

These gaps explain why India’s health and education outcomes trail BRICS peers despite faster economic growth. You cannot build a high-income country on the foundation of educational deficiency, precarious health, and entrenched inequality.

The Voices From the Field – What They’re Actually Saying

Expert Assessment: Systemic Skepticism

Ashok Agrawal, president of the All India Parents’ Association, offered blunt criticism: “The budget’s increased allocations are strategic optics to create an impression of welfare concern, not actual commitment. We’ve lost nearly 1 lakh government schools in the last decade due to chronic underfunding. No budget allocation reverses that.”

Mitra Ranjan of the Right to Education Forum highlighted the deeper mathematics: “School and higher education constitute 2.6% of the total budget and 0.36% of GDP for 2026-27. This is insufficient to combat entrenched inequalities. Without doubling education spending in real terms over five years, India cannot achieve the learning outcomes necessary for a high-income transition.”

Most devastating was economist Venkatesh Atreya’s assessment: “The Union Budget 2026-27 doesn’t clearly show where jobs will come from, how rural poverty will be addressed, or how youth empowerment will actually happen. Skilling, projected as a solution, is misleading. These programmes may work for those with some education needing specific skills. But what about the vast young population with no employment opportunities at all? Corporations exploit this by hiring engineering graduates as two-year apprentices at poverty wages, then discarding them. Calling this employment generation is simply not correct.”

The consensus from serious analysts: allocations are increasing nominally, but structural problems aren’t being addressed. The Union Budget 2026-27 manages symptoms while ignoring disease causes.

The Opportunity That Could Have Been

Structural Changes India Could Afford But Won’t Make

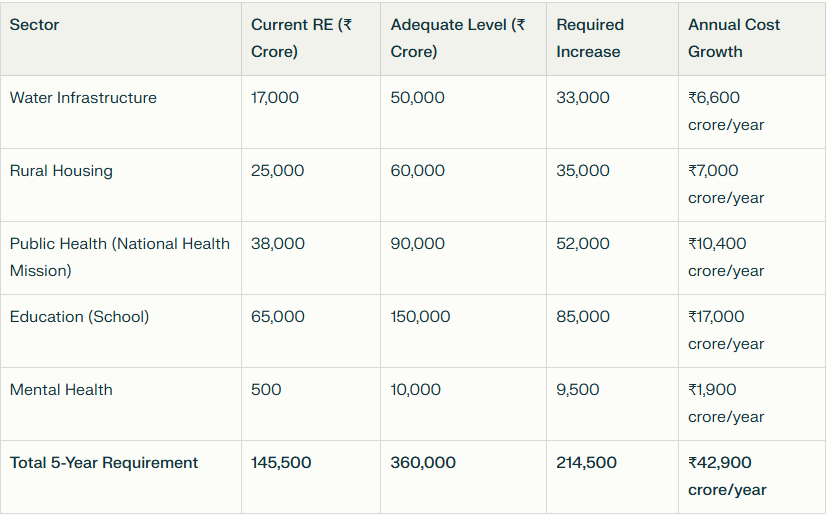

If India redirected just 3% of its ₹43+ lakh crore total budget toward transformative social investment, the following would become possible:

Over five years:

- Universal tap water to every rural household (not 55% coverage)

- Dignified housing for 100+ million below-poverty-line households

- Primary health centers in every 1,000 people (vs. current 1 per 5,000)

- Teacher recruitment to achieve 1:30 student-teacher ratios (vs. 1:50 current)

- Mental health services in every district town

- Universal old-age pensions at subsistence levels

- Caregiver infrastructure for 150+ million elderly and young children

- Agricultural debt restructuring + MSP reform + crop insurance overhaul

This wouldn’t require austerity elsewhere. It would require redirecting capex allocation marginal amounts toward human development. Current capex expansion can continue; social spending can simultaneously increase. The political choice hasn’t been made. The appetite for transformative social investment isn’t there – not because of lack of resources, but because of competing priorities and insufficient political pressure.

Social Investment Opportunity Cost

Required as % of projected total government expenditure (2026-27): 1.0%

Sources: Union Budget 2026-27 scheme allocations (mainly RE 2025–26)

From Budget to Actual Well-Being – The Work That Remains

The Honest Reckoning

The Union Budget 2026-27: Social Impact Analysis on India reveals a paradox wrapped in contradiction. The government announces revolutionary schemes – care economy jobs, skilling expansion, employment guarantees – that would genuinely transform lives if executed. Simultaneously, the fundamental fiscal constraints and historical implementation gaps suggest that these announcements are more aspirational than achievable. I don’t say this with cynicism but with hard-earned realism. Good intentions multiplied by zero execution equals zero impact.

The Structural Changes Required

For the budget’s social sector components to actually reach people and transform outcomes, several structural changes are essential:

1. Fiscal Reallocation (Not Expansion): India doesn’t need to expand the fiscal deficit. It needs to reallocate 2-3% of budgeted capex toward human development. This choice is political, not mathematical.

2. Implementation Accountability: Every rupee must be tracked from allocation to utilization. Real-time dashboards showing BE vs. RE vs. Actuals should be mandatory public reporting. Budget promises should carry legal liability if shortfalls exceed 10%.

3. State Capacity Building: Weak implementation stems from inadequate staff, outdated systems, and insufficient training. Invest ₹20,000 crore over five years in state administrative capacity – hiring, training, and technology upgrades. Implement through competitive performance benchmarking.

4. Demand-Side Interventions: Supply is necessary but insufficient. Ensure poor households have documents, information, and trust to access schemes. Community health workers and education workers should receive stipends to become scheme ambassadors.

5. Sectoral Structural Reform: Allocations can’t substitute for sectoral reform. Agriculture needs MSP reform, agricultural debt restructuring, and crop insurance overhaul – not drone subsidies. Education needs teacher recruitment, infrastructure upgrades, and curriculum modernization – not AVGC labs without basic infrastructure. Health needs public system strengthening – not medical tourism hubs.

6. Vulnerable-Group Protection: Rather than hoping skilling creates jobs or growth creates employment, directly protect vulnerable groups – elderly pensions at subsistence levels, widow support, disability assistance – through expanded allocation to assured social protection schemes.

The Personal Dimension – What You Can Do

Personally, this analysis asks uncomfortable questions. As citizens, educators, healthcare workers, entrepreneurs, or simply engaged observers:

- If you’re in government: Can you resist the temptation to announce allocations that you know won’t be spent? Can you fight within bureaucracy for genuine implementation rather than optics?

- If you’re an educator: Can you document education sector failures – the missing teachers, collapsed infrastructure, learning deficits – and share them publicly, holding budget promises accountable?

- If you’re in healthcare: Can you track the gap between promised and actual health spending in your district? Can you organize your community around that gap?

- If you’re a parent: Can you ask your elected representatives specific questions about implementation – not allocations? When is your child’s school getting its promised teachers? When is your locality getting its promised water?

- If you’re an observer: Can you move beyond reading budget headlines and actually examine the Revised Estimates published months later? That’s where the real story lives.

The Union Budget 2026-27 ultimately depends on whether all of us – policymakers, workers, parents, activists – recognize that equity isn’t charity or benevolence. It’s the essential foundation of shared prosperity. When 375 million people live in poverty despite GDP growth, when water doesn’t reach villages, when farmers die by suicide, when children don’t learn, when elderly die alone – that’s not just individual suffering. That’s collective failure with macroeconomic consequences.

My Final Thoughts

I began this analysis by asking a simple question: Who benefits and who gets left behind in the Union Budget 2026-27?

The answer: It depends entirely on what happens between now and next February when the Revised Estimates are published.

If allocations hold – if the budget proves capable of execution – then skilling truly could transform 100,000 youth. Care economy jobs could meaningfully improve women’s economic position. Rural employment could protect vulnerable households. That’s possible.

If history repeats – if allocations are revised downward, if implementation gaps persist, if the gap between promise and delivery grows, then the budget becomes what it has been for a decade: an annual performance of concern masking structural underinvestment in the social sector. If history repeats – if allocations are revised downward, if implementation gaps persist, if the gap between promise and delivery grows, then the budget becomes what it has been for a decade: an annual performance of concern masking structural underinvestment in the social sector.

The choice between these futures isn’t determined by budget announcements. It’s determined by what happens in district offices, block-level committees, and state capitals over the coming 10 months. It’s determined by whether citizens demand accountability, whether civil servants prioritize implementation over optics, whether politicians accept that real transformation requires sustained, genuine investment.

Until proven otherwise through Revised Estimates, implementation data, and actual outcome improvements, healthy skepticism is the only rational response to even the most eloquent budget speech.

Making Union Budget 2026-27 Actually Matter

Don’t just accept allocations as final. Demand Revised Estimates and actual spending data. Track which schemes deliver and which don’t. Share implementation failures publicly. Vote for accountability. Organize with your community around budget promises in your sector.

Because in the end, the Union Budget 2026-27 will be judged not by what was announced in Parliament, but by what actually reaches the 375 million people waiting for water, housing, healthcare, education, and dignity.

At ExpressIndia.info, we will follow up through the year with a simple, non-partisan scoreboard: what got spent, what got delayed, what reached citizens, and what remained a headline. We’ll track the biggest social promises – water, housing, health, education, skilling, welfare – and compare what was planned versus what actually happened, using official mid-year revisions and end-year actuals as they emerge. If the budget performs, we’ll say so clearly. If it under-delivers, we’ll show where the gap opened – and what it means for ordinary people.

Express your opinion in the comments on what is your take on the Union Budget 2026-27 🗣️🎤📢

#UnionBudget2026-27 #SocialImpact #IndiaBudget #PublicPolicy #InclusiveDevelopment

Super Analysis