Well, here we are – September 22nd, 2025 – the day when India gets a major tax makeover with the launch of GST 2.0 Reforms. Before you yawn thinking it’s just more tax talk, hold on! Indeed, this reform has the potential to change the way every one of us shops, saves, works, and even dreams. Effectively, it sends a clear message that simplifying taxes can be – and should be – a national celebration. So, buckle up! Because we’re about to unbox what this means for you, me, farmers, shopkeepers, entrepreneurs, and yes – even that aunty who keeps bargaining at the vegetable market. Spoiler alert: it’s not all sunshine and rainbows, but definitely a brighter dawn awaits us all. 🌅✨

Simplifying Taxes for Real People: Less Wait, More Clarity 🎯

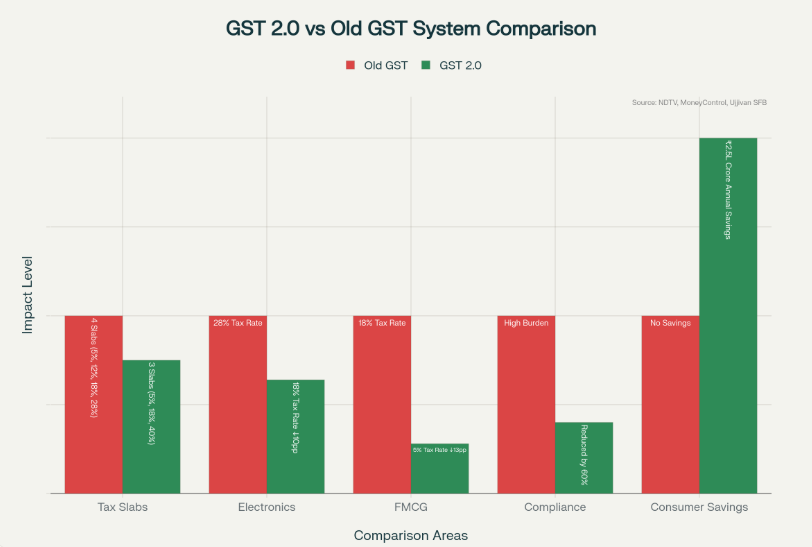

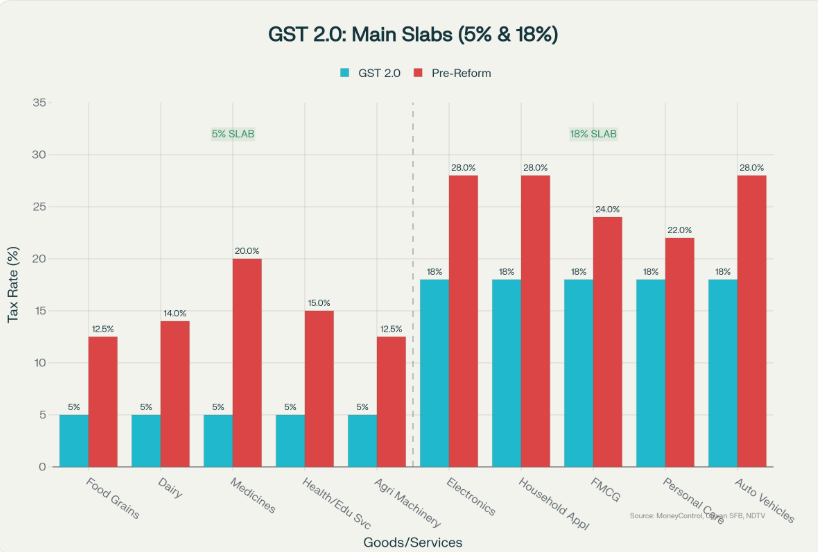

To kick things off, India is ditching the confusing original GST structure. Instead of four cumbersome tax slabs (5%, 12%, 18%, 28%), we now have just two main rates: 5% for essentials and 18% for most other goods and services. Additionally, there’s a 40% “sin tax” for luxuries and things we probably shouldn’t indulge in often (tobacco, fancy cars – looking at you, Mr. Spendthrift). Therefore, this clever trimming isn’t just about numbers; it’s a step towards making life easier for the people who dread the tax season more than their Mondays. As a small business owner friend put it, “Finally, a tax system that speaks human!” 😅

Who’s Really Winning Here?

- Families get relief with cheaper groceries, medicines, and school supplies. Thanks to the 5% slab, my tea chai and morning bread get friendlier prices, which means more chai time ☕🥖.

- Entrepreneurs and MSMEs see faster refunds and lesser paperwork, freeing up cash to hire new talent or buy that much-needed coffee machine ☕ for the office.

- Farmers rejoice with lower taxes on tractors and fertilizers, boosting rural economies and making sure the “Made in India” farmer stays strong.

- Women and youth gain opportunities as economic hurdles lower and access becomes fairer, fueling dreams and small businesses sprouting up everywhere.

GST — Old System vs New System 📊

| Feature | Old GST (2017-2025) | GST 2.0 Reforms (2025 and Beyond) |

|---|---|---|

| Tax Slabs | 4 (5%, 12%, 18%, 28%) | 3 (5%, 18%, 40%) |

| Essentials Tax Rate | 12-18% | Mostly 5% or nil |

| Standard Goods Rate | 18-28% | Mostly 18% |

| Luxury/Sin Goods Rate | 28-40% | 40% |

| Compliance Complexity | Paper-heavy, confusing | Digital-first, streamlined |

| Consumer Savings | Varies | Estimated ₹2.5 lakh crore annually |

Sources: NDTV, MoneyControl, Ujjivan SFB

Pumping Up Your Wallet: More Power to the People 💸🛍️

Firstly, GST 2.0 brings a major boost to household budgets by drastically reducing taxes on many essential goods and daily-use items, thereby putting more money directly into people’s pockets. For example, the tax rate on cholesterol-friendly foods like Ultra-High Temperature (UHT) milk, paneer, roti, khakhra, and pizza bread has dropped to zero, making nutritious options easier to afford. Moreover, packaged juices, chocolates, biscuits, shampoos, soaps, toothpaste, and various medicinal supplies now attract only a 5% GST rate instead of the earlier 12-18% slab. Consequently, consumers get substantial relief on monthly grocery bills, improving overall affordability and consumption power. This, in turn, stimulates demand, driving growth in manufacturing and service sectors, which benefits the entire economy.

Additionally, the reform slashes GST on consumer durables such as air conditioners, televisions, dishwashers, and small cars, dropping rates from 28% to 18%. Therefore, families looking to modernize homes or buy cleaner, smaller vehicles find it financially easier to do so, supporting sustainability goals. Importantly, life and health insurance premiums have been fully exempted, providing greater financial security for citizens. Meanwhile, personal care and wellness services like gyms, yoga centers, salons, and barbers now face a lowered rate of 5%, encouraging broader access to health and well-being. All in all, these focused GST cuts empower consumers, especially the middle and lower-middle classes, by easing cost pressures and enabling a better quality of life. With increased disposable income, people can spend more, save more, and contribute to a virtuous cycle of economic growth and improved livelihoods. ✨🛒👛

GST 2.0 Tax Slabs and Complete Goods Categorization 🛒📊

5% GST Slab: Essential and Daily Use Goods

This slab covers a vast array of everyday essentials and personal care items, making life more affordable for households. Included are:

- Food items: UHT milk, pre-packaged paneer (chhena), roti, pizza bread, khakhra, dry fruits (almonds, pistachios, cashews, walnuts), dried fruits (figs, mango, guava), butter, ghee, cheese, dairy spreads, chocolates, pasta, biscuits, cakes, pastries, namkeen, sauces, jams, ice cream, and sugar confectionery.

- Beverages: Packaged fruit juices, coconut water, tea and coffee extracts, plant-based milk, and soya milk drinks.

- Seafood: Preserved or processed fish, crustaceans, molluscs, and caviar substitutes.

- Medical and health products: Life-saving medicines, medical oxygen, diagnostic kits, surgical gloves, bandages, and personal care items like talcum powder, hair oil, soaps, shampoos, toothpaste, shaving cream, aftershave lotion, and dental floss.

- Baby care: Feeding bottles and plastic nipples.

- Household goods: Wooden furniture and articles, bamboo flooring, handcrafted candles, leather goods including handbags and gloves, cork products, handmade paper, cartons, corrugated boxes, and biodegradable paper bags.

- Fitness and wellness services: Gyms, wellness centers, yoga services.

- Agricultural and industrial inputs: Tractor tyres and tubes, select bio-pesticides, drip irrigation systems, fertilisers.

18% GST Slab: Standard Goods and Many Consumer Products

This category comprises most other consumer goods and services, including:

- Consumer durables and electronics: Air-conditioners, televisions, dishwashers, monitors, projectors.

- Apparel and textiles: Clothing (knitted or crocheted) and made-up textile articles priced above ₹2,500.

- Vehicles: Motorcycles up to 350 cc, small hybrid cars, electric vehicles, and auto parts.

- Construction materials: Cement, certain machinery including sewing machines and parts.

- Paper products: Various coated, corrugated, and composite paper and paperboard types.

- Personal insurance including life and health.

40% GST Slab: Luxury, Sin, and Special Category Goods

This highest slab targets luxury and sin goods to discourage excessive consumption:

- Tobacco products, including pan masala and manufactured tobacco substitutes.

- Luxury vehicles: Motor cars above small threshold sizes, yachts, pleasure boats.

- High engine capacity motorcycles (above 350cc).

- High value apparel and textiles (beyond specified limits).

- Gambling and betting services including casinos, race clubs, money gaming.

- Aerated, caffeinated, and carbonated beverages.

- Specified firearms and associated accessories.

This comprehensive categorization under GST 2.0 aligns India’s tax structure with simplicity, progressivity, and economic fairness while promoting essential consumption and curbing undesirable goods consumption.

Sources: MoneyControl, Ujjivan SFB, NDTV

MSMEs and Job Creation: The Economy’s Engines 💼

Micro, Small, and Medium Enterprises (MSMEs) are the lifeblood of India’s economy, contributing nearly 30% to GDP and employing over 260 million people nationwide 🌾🏭. Consequently, their health impacts millions of livelihoods and the nation’s growth. GST 2.0 Reforms simplify tax compliance and reduce rates in crucial sectors like textiles, food processing, and leather, substantially easing operational burdens 🧵🍲. This enables MSMEs to invest more in expansion and workforce development, which directly powers job creation.

Moreover, digital filing and instant refunds improve cash flow management—a historic challenge for smaller businesses 💻💸. As a result, MSMEs can focus more on innovation and growth than paperwork and delays. This reform is expected to generate significant employment, especially benefiting women and youth entrepreneurs 👩💼👨💼. Aligned with national campaigns like “Make in India,” GST 2.0 reinforces MSMEs as engines driving inclusive growth and a sustainable economic revival 🔧🌱.

Supporting the “Made in India” Vision 🏭✨

First and foremost, GST 2.0 Reforms significantly boost the “Made in India” initiative by addressing tax anomalies such as inverted duties, where raw materials were often taxed more than finished goods. Consequently, this rationalization leads to lower production costs for domestic manufacturers, making Indian products more competitive both at home and on the global stage. Moreover, this reduction in tax burdens helps key sectors – including textiles, handicrafts, leather, and agro-based industries – which are vital for the livelihoods of millions of MSMEs and exporters. Therefore, more artisans and small-scale producers can scale their businesses, create jobs, and tap into international markets. Additionally, these reforms encourage environmentally sustainable manufacturing by lowering GST on green inputs like solar panels and biodegradable packaging. Altogether, GST 2.0 aligns economic growth with environmental responsibility, promoting a modern and sustainable industrial ecosystem.

Furthermore, GST 2.0 streamlines compliance by establishing faster digital refunds and an appellate tribunal for the speedy resolution of disputes, thus freeing entrepreneurs to focus on scaling their ventures and investing in innovation. In addition, the reform simplifies tax filing, especially for businesses in rural and semi-urban areas. Consequently, this synergy between tax reform and national initiatives like PM Gati Shakti and Atmanirbhar Bharat propels India’s manufacturing sector forward. Notably, this reform acts as a catalyst for inclusive growth by empowering businesses of all sizes to compete globally while fostering sustainable economic development. Ultimately, GST 2.0 takes a strategic leap forward, making “Made in India” synonymous with quality, competitiveness, and green growth 🚀🌱💪.

GST 2.0: Encouraging Sustainable Growth 🌱🌞♻️

Importantly, GST 2.0 Reforms play a pivotal role in accelerating India’s transition towards a sustainable and green economy. By reducing tax rates on renewable energy equipment such as solar panels, wind turbines, and photovoltaic cells, the reforms lower the initial capital costs for clean energy projects. Consequently, this makes renewable energy adoption more feasible for households and industries alike, supporting India’s ambitions to become a global leader in green energy. Moreover, the government has cut GST on biodegradable plastics, bio-pesticides, and effluent treatment services, which encourages eco-friendly manufacturing practices and better waste management. These changes not only stimulate investments aligned with environmental goals but also create green jobs in sectors like waste treatment and sustainable agriculture, thereby boosting both economic growth and ecological well-being.

Furthermore, the GST cut on commercial transport vehicles and passenger buses incentivizes fleet modernization, which can reduce urban congestion, vehicular emissions, and dependence on outdated fossil-fuel-based transport. This is crucial for improving air quality in major Indian cities while fostering sustainable urban development. Similarly, by aligning fiscal policy with climate commitments such as the Paris Agreement and India’s net-zero pledge by 2070, GST 2.0 ensures economic progress does not come at the environment’s expense. Additionally, faster digital compliance and streamlined tax administration under the reforms enhance access for green industries and MSMEs, encouraging them to innovate and expand sustainably. Altogether, GST 2.0 embodies a balanced, future-ready approach – fostering economic revival that works hand-in-hand with environmental stewardship, ensuring that growth today preserves prosperity for generations to come. 🌍💚

Tackling Inequality and Inflation ⚖️📉

Strategically, GST 2.0 Reforms address economic inequality by lowering taxes on essential goods, thereby significantly easing the cost of living for millions of middle and lower-income households. For instance, essentials like UHT milk, packaged breads, and daily-use hygiene products now attract just a 5% GST rate compared to higher rates before, directly putting more disposable income into the hands of ordinary consumers. Furthermore, luxury goods and sin products, including tobacco, pan masala, and high-end cars, are taxed heavily at 40%, which not only discourages excess consumption but also helps redistribute resources by funding social welfare programs. Therefore, the reform simultaneously promotes fairness and progressive taxation, benefitting vulnerable sections of society while maintaining fiscal sustainability.

Moreover, as a result of these measures, inflationary pressures are expected to ease substantially. GST cuts on over a dozen high-consumption items contribute to reducing the Consumer Price Index (CPI). This is critical because inflation disproportionately affects the poor, who spend a larger share of income on necessities. Moreover, the timing of these reforms just before the festive season helps boost consumer confidence and spending, which supports overall economic growth. Importantly, while external factors like Trump’s tariff tensions may influence price volatility, the combined effect of GST 2.0 and government stimulus is likely to moderate inflation in the medium term. Altogether, GST 2.0 serves as both an economic stabilizer and a step toward reducing inequality, fostering a more inclusive growth environment that benefits not only individuals but also the broader economy. 💪🛒📉

Challenges and the Road Ahead ⚠️🛤️

As a matter of fact, despite its promising start, GST 2.0 faces several notable challenges that need urgent attention to ensure long-term success. For instance, revenue shortfalls around ₹48,000 crore annually have created fiscal pressure, especially for state governments reliant on GST transfers, forcing potential cutbacks in welfare and infrastructure spending. Moreover, Input Tax Credit (ITC) complexities persist due to exemptions and zero-rated supplies, leading to cascading costs for some sectors and increasing inflationary risks upstream. Furthermore, classification ambiguities linger, particularly with the new 40% sin goods slab, causing uncertainty for businesses and complicating pricing decisions. Not to mention, many smaller businesses, especially MSMEs, struggle to keep pace with technological and compliance upgrades, leading to higher costs and learning curves. Additionally, the GST Appellate Tribunal (GSTAT), crucial for resolving disputes swiftly, remains non-functional in many states, resulting in litigation backlogs and undermining taxpayer confidence. In summary, while GST 2.0 simplifies slabs, such operational inefficiencies and transitional pains pose challenges to its smooth rollout.

Nevertheless, looking ahead, adopting targeted solutions can pave the way for GST 2.0’s robust growth and impact. Specifically, strengthening GST administration by leveraging data analytics and AI can enhance compliance monitoring and reduce evasion. Moreover, operationalizing GSTAT across all states will accelerate dispute resolution and rebuild trust. Additionally, providing MSMEs with capacity-building support and simpler compliance mechanisms will enable more inclusive participation in the formal economy. Equally important is the close monitoring of fiscal impacts to maintain social and infrastructure investments without compromise. Periodic slab reviews based on economic realities will ensure revenue sufficiency and policy relevance. Lastly, vigorous taxpayer education campaigns will be vital to smooth the transition and maximize benefits. Ultimately, with collective commitment from governments, businesses, and citizens, GST 2.0 can fulfill its promise of a transparent, fair, and growth-friendly tax regime, driving India’s economic aspirations forward. 🚀💼📈

GST 2.0: A New Chapter for an Inclusive India 🎉✨

In conclusion, GST 2.0 represents a transformative step toward a simpler, fairer, and more growth-oriented tax system that benefits all Indians. By reducing taxes on essentials, consumer durables, and health services, it puts more money into the hands of families and promotes greater economic activity. Additionally, streamlined compliance eases the burden on businesses, especially MSMEs, fostering job creation and formalization. Consequently, the reform sets in motion a virtuous cycle of higher consumption, increased savings, and broader economic inclusion.

Moreover, despite short-term fiscal challenges, GST 2.0 aligns with national priorities like Atmanirbhar Bharat and PM Gati Shakti, supporting industrial growth and infrastructure development. It also incentivizes sustainable practices and improves dispute resolution, paving the way for resilient, inclusive, and environmentally conscious development. Ultimately, GST 2.0’s success depends on collaborative efforts among governments, businesses, and citizens, making it a vital foundation for India’s next phase of economic prosperity and social progress. 🌱🤝

Take charge of your future by embracing GST 2.0, where simplicity meets growth and opportunity! 🚀💼 Act now and be part of India’s transformation towards prosperity and inclusion! 🔥

#GST2 #TaxReform #IndianEconomy #EaseOfDoingBusiness #MadeInIndia

It is not actually any reform; rather a course correction or setting right a wrong.

They applied GST without proper application of mind like the demonetisation.

Now they are compelled to do this exercise after the ‘Vote Chori’ allegation and the milage that Rahul gets nationwide particularly in Bihar where the election is around the corner.

It is simply a bit of cutting down the arrogance. Remember how Sitaraman made a hotelier to apologise in Coimbatore simply because he pointed out the anomalies in the GST.